Right Plan for Your Business

- Expert assisted process

- Your company name is filed in just 2 - 4 days

- DSC in just 4 - 7 days

- SPICe+ form filing in 14 days*

- Incorporation Certificate in 28 - 35 days

- Company PAN+TAN

- DIN for directors

- Expert assisted process

- Your company name is filed in just 2 - 4 days

- DSC in just 4 - 7 days

- SPICe+ form filing in 14 days*

- Incorporation Certificate in 28 - 35 days

- Company PAN+TAN

- DIN for directors

- Digital welcome kit that includes a checklist of all post-incorporation compliances

- Expert assisted process

- Your company name is filed in just 2 - 4 days

- DSC in just 4 - 7 days

- SPICe+ form filing in 14 days*

- Incorporation Certificate in 28 - 35 days

- Company PAN+TAN

- DIN for directors

- Digital welcome kit that includes a checklist of all post-incorporation compliances

- MSME registration Free 🎉

- Expedited Trademark application filing

A2Z Registration Premium

Ideal for new startups or growing businesses aiming to expand their operations, the A2Z Registration Premium service ensures a quick and seamless company incorporation process.

🌟 Key Features

Expert Assistance: Get professional help in preparing your incorporation application with complete accuracy and proper documentation.

Fast Submission: All required applications are filed and submitted within 2 working days.

Quick Incorporation: Company registration is typically completed within 5 working days, depending on MCA portal availability.

📝 Important Notes

We make every effort to retain your existing business name, wherever possible.

If your preferred name is unavailable, our experts will recommend suitable alternative names for easy approval.

Pricing: Starting from ₹25,000+GST, depending on business requirements. Includes first-year compliance, such as auditor appointment and annual filing.

Overview

Registering a Private Limited Company in India gives entrepreneurs the benefits of limited liability, a separate legal identity, and several tax advantages. Governed by the Companies Act, 2013, the process involves obtaining a Digital Signature Certificate (DSC), a Director Identification Number (DIN), and submitting valid identity and address proofs.

Through the SPICe+ (Simplified Proforma for Incorporating Company Electronically Plus) form, applicants can conveniently complete a single application for name reservation, incorporation, and the allotment of PAN, TAN, and GST registration. Once approved by the Registrar of Companies (RoC), a Certificate of Incorporation is issued — legally recognizing the company as an entity that can own property, enter contracts, and conduct business. After incorporation, the company must fulfill statutory obligations like annual return filing and financial reporting.

At A2Z Registration, we make the entire incorporation journey simple, transparent, and efficient. Our team provides end-to-end support for private limited company registration, from documentation and filing to compliance and approvals. We ensure every step is handled with accuracy and professionalism, while maintaining clear and upfront pricing with no hidden fees.

What is a Private Limited Company (Pvt Ltd)?

A Private Limited Company (Pvt Ltd) is a distinct legal business entity formed under the Companies Act, 2013. It provides limited liability protection to its shareholders, ensuring that their personal assets remain secure against business debts or losses.

This type of company restricts the transfer of shares and requires a registered office address in India. Due to its structured framework and legal credibility, it is considered the most preferred business form for startups and small-to-medium enterprises (SMEs) looking for investor confidence, business scalability, and professional recognition.

Companies Act, 2013

According to Section 2(68) of the Companies Act, 2013, a Private Limited Company is defined as a company having such minimum paid-up share capital as may be prescribed, and which, through its Articles of Association (AOA):

(a) Restricts the right of shareholders to transfer their shares;

(b) Limits the total number of members to 200, excluding current and former employees; and

(c) Prohibits any public invitation to subscribe to its shares or other securities.

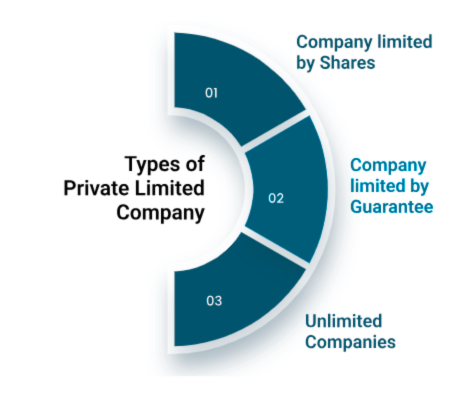

Types of Private Limited Companies (Pvt. Ltd.)

Selecting the appropriate type of Private Limited Company is crucial for ensuring legal protection, effective financial management, and smooth business operations. In India, private limited companies are primarily classified based on their liability structure and capital framework.

The main categories are as follows:

1️⃣ Company Limited by Shares

This is the most common and preferred form of private limited company. In this structure, the liability of shareholders is restricted to the unpaid portion of their shares. This means that shareholders’ personal assets remain protected even if the company incurs debts or losses.

It’s an ideal choice for entrepreneurs and startups looking to raise equity capital from private investors or co-founders without exposing personal wealth to business risks.

2️⃣ Company Limited by Guarantee

A company limited by guarantee operates without share capital. Instead, each member undertakes to contribute a specific amount in the event of the company’s winding up.

This type of company is typically chosen by non-profit organizations, charitable trusts, and foundations, where the focus is on achieving social or community objectives rather than distributing profits. Members’ liability is limited only to the amount they guarantee.

3️⃣ Unlimited Company

In an unlimited company, members’ liability has no upper limit. If the company incurs losses or debts, the members are personally responsible for repaying them.

This form of company is rarely used but may suit closely held businesses or partnerships where members prefer complete control and flexibility, even if it comes with full personal liability.

Requirements for Pvt Ltd Company Registration

For private limited company registration in India, certain legal and procedural requirements must be fulfilled under the Companies Act, 2013. Meeting these minimum conditions ensures a valid incorporation and smooth operation post-registration.

Minimum Two Directors

A private limited company must have at least two directors. At least one director must be a resident of India, meaning they have stayed in the country for a minimum of 182 days during the financial year.

Minimum Two Shareholders

The company must have a minimum of two shareholders. Directors and shareholders can be the same individuals, and both individuals and corporate entities are eligible to be shareholders.

Registered Office Address

A valid Indian address must be provided as the company’s registered office. Proof of address and a NOC (No Objection Certificate) from the property owner are required.

Digital Signature Certificate (DSC)

All proposed directors must have a valid Digital Signature Certificate to digitally sign incorporation documents.

Director Identification Number (DIN)

Each director must obtain a DIN, which serves as a unique identification number issued by the Ministry of Corporate Affairs.

Company Name

A unique name must be chosen for the company, which is not identical or similar to existing companies or trademarks. Meeting these requirements is essential before filing the SPICe+ form for incorporation.

Meeting these requirements is essential before filing the SPICe+ form to register private limited company.

8 Quick Steps to Register a Pvt Ltd Company in India

Registering a Private Limited Company in India under the Companies Act, 2013 is a structured process regulated by the Ministry of Corporate Affairs (MCA).

Here’s a step-by-step guide to help you complete the registration smoothly:

Step 1: Get a Digital Signature Certificate (DSC)

Every proposed director must have a valid Digital Signature Certificate (DSC) to sign and submit electronic forms and documents securely on the MCA portal.

Step 2: Obtain Director Identification Number (DIN)

Each director needs a unique Director Identification Number (DIN), which serves as an official identification for company directors during the incorporation process.

Step 3: Apply for Company Name Approval (SPICe+ Part A)

Choose a unique company name and submit it online through SPICe+ Part A for approval by the MCA. The name should not resemble any existing business or trademark.

Step 4: Prepare Incorporation Documents

Collect and organize all necessary documents, including identity proof, address proof of directors, and registered office address proof such as a rent agreement, utility bill, or ownership document.

Step 5: File SPICe+ Part B and Linked Forms (AGILE-PRO, eMOA, eAOA)

Complete the incorporation process by submitting SPICe+ Part B, along with the linked forms AGILE-PRO, eMOA (Memorandum of Association), and eAOA (Articles of Association). These include details such as authorized capital, business objectives, and internal regulations.

Step 6: Apply for PAN, TAN, and GST

As part of the integrated online filing, apply for the company’s Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN). You can also opt for GST registration if applicable.

Step 7: Verification and Certificate of Incorporation by RoC

After reviewing the application and documents, the Registrar of Companies (RoC) verifies the information and issues a Certificate of Incorporation, which includes the Corporate Identification Number (CIN).

Step 8: Post-Incorporation Compliance

Once incorporated, the company must:

Open a current bank account in the company’s name.

Issue share certificates to shareholders.

Maintain financial and statutory records.

Ensure regular compliance with ROC filings and company law provisions.

This structured pvt ltd company registration ensures limited liability, separate legal entity status, and ease in securing funding from financial institutions. Please note: The registration process for a Private Limited Company typically takes 7 to 10 days.

Ready to Register a Pvt Ltd Company Online?

Get expert help with name approval, DSC, DIN, MOA/AOA drafting and Certificate of Incorporation in one seamless process

Documents Required for Private Limited Company Registration

To register a Private Limited Company in India, specific documents are required to verify the identity, address, and authorization of directors and shareholders. These requirements are prescribed by the Ministry of Corporate Affairs (MCA) under the Companies Act, 2013.

🧑💼 For Indian Nationals

Identity Proof:

PAN Card (mandatory)

Passport / Aadhaar Card / Voter ID / Driving License

Address Proof:

Latest Utility Bill (Electricity, Water, or Telephone)

Bank Statement (issued within the last 2 months)

🌍 For Foreign Nationals

Identity Proof:

Passport (mandatory)

Address Proof:

Driver’s License, Bank Statement, or Residence Permit/Card

(Note: All documents must be notarized and apostilled, as per MCA guidelines.)

🏢 For Corporate Shareholders

Board Resolution: A formally signed resolution approving the investment in the proposed company.

Certificate of Incorporation: Proof of registration of the parent or investing company.

🏠 Registered Office Proof

Utility Bill: Latest electricity bill or property tax receipt (not older than 30 days).

Rent Agreement or NOC: If the property is rented, provide a Rent Agreement and a No Objection Certificate (NOC) from the property owner.

📑 Additional Incorporation Documents

Memorandum of Association (MoA): Defines the business objectives and purpose of the company.

Articles of Association (AoA): Specifies the internal rules and management structure of the company.

Declaration & Consent Forms: Includes Form INC-9 (declaration by directors/shareholders) and Form DIR-2 (consent to act as director).

Digital Signature Certificate (DSC): Mandatory for all proposed directors for e-filing purposes.

Director Identification Number (DIN): A unique identification number required for every director.

📷 Common for All Applicants

Passport-size photographs of all proposed directors and shareholders.

Timeline for Private Limited Company Registration

The process of Private Limited Company registration in India generally takes 10 to 15 working days, depending on the availability of documents, name approval, and MCA processing time. Below is a step-by-step timeline for completing your company incorporation smoothly:

🗂️ 1. Company Name Reservation (3–4 Days)

Submit your desired company name through the MCA SPICe+ Part A form. Once reviewed and approved, the name is reserved for your new company.

👨💼 2. Director Identification Number (DIN) (Approx. 3 Days)

Apply for a Director Identification Number for each proposed director. This unique number is mandatory to be part of any company’s board.

🔐 3. Digital Signature Certificate (DSC) (2 Days)

Each director must obtain a Digital Signature Certificate (DSC) to sign and file incorporation forms online securely.

🧾 4. Drafting of MOA & AOA (2–3 Days)

The Memorandum of Association (MoA) and Articles of Association (AoA) are prepared, defining the company’s objectives and internal management structure.

📝 5. Filing Incorporation Forms with MCA (5–7 Days)

All required incorporation forms — SPICe+ Part B, eMoA, eAoA, AGILE-PRO — are submitted along with the necessary proofs and declarations to the Ministry of Corporate Affairs (MCA).

🏢 6. Certificate of Incorporation (2–3 Days)

Once the Registrar of Companies (RoC) verifies and approves the documents, the Certificate of Incorporation (COI) is issued, officially establishing your company.

⚠️ Important Note

Timelines may vary depending on:

Accuracy and completeness of submitted documents

Government holidays or backend delays at MCA

Corrections or clarifications requested during approval

The government fees for registering a Private Limited Company (Pvt Ltd) in India depend on the state of registration and the company’s authorised share capital. These charges include stamp duty, filing fees, and costs related to Digital Signature Certificates (DSCs) and Director Identification Numbers (DINs).

The total registration cost may slightly vary from state to state, as each jurisdiction has its own stamp duty rates and compliance charges. Additionally, the Ministry of Corporate Affairs (MCA) may periodically revise these fees as per new regulations or updates.

✅ Key Points:

Fees are calculated based on authorised capital and state regulations.

Stamp duty varies for each state.

DSC and DIN costs are additional but mandatory.

Final charges depend on MCA updates and document verification requirements.

Benefits of a Pvt Ltd Company In India

A Private Limited Company (Pvt Ltd) offers a range of advantages that make it a popular choice for entrepreneurs and startups:

Limited Liability

Shareholders are only liable to the extent of their shareholding—personal assets are protected.

Separate Legal Entity

The company has its own legal identity. It can own property, enter contracts, and face legal proceedings independently.

Easier Access to Capital

Pvt Ltd companies can raise funds through equity, loans, or venture capital, attracting investors more easily.

Tax Benefits

Eligible for lower corporate tax rates and deductions on business expenses like salaries, rent, and utilities.

Professional Image

Registration adds credibility, helping in building trust with clients, partners, and investors.

Perpetual Existence

The company remains unaffected by changes in ownership or management ensuring business continuity.

Easy Share Transfer

Shares can be transferred with shareholder approval, offering flexibility in ownership without disrupting operations.

Need Help Deciding Between Company Structures?

Our experts can guide you through the process of registering a Private Limited Company.

Start your company journey by checking name availability now.

Choosing the right company name is the first big step in building a standout brand. But it’s not just about creativity. Your company name must be legally available and compliant with MCA guidelines. Use our free search tool to instantly check if your desired name is up for grabs.

Need help finalising the perfect name or ensuring it meets legal requirements? Try our Company Name Search service for expert support, faster approvals, and end-to-end guidance.

Why Choose A2Z Registration for Private Limited Company Setup?

Registering a Private Limited Company is a major milestone in building your business. With A2Z Registration, you get expert guidance, complete transparency, and quick turnaround — all in one place.

1️⃣ End-to-End Incorporation Assistance

From SPICe+ form filing to MCA approval, A2Z Registration manages the entire incorporation process for you — ensuring a smooth, error-free, and fast registration experience.

2️⃣ Company Name & Address Proof Guidance

We help you pick a unique, MCA-compliant company name and assist in preparing accurate address proof documents such as rental agreements or utility bills for verification.

3️⃣ Upgrade from OPC to Pvt Ltd

Already running a One Person Company (OPC)? We make it easy to convert and scale up to a Private Limited Company, enabling better growth potential, investor trust, and credibility.

4️⃣ Bank Account & Capital Consultation

After incorporation, our experts guide you in opening a company bank account and determining suitable authorised and paid-up capital for your business structure.

5️⃣ Digital Incorporation Certificate + Global Support

Get your official Certificate of Incorporation, PAN, and TAN delivered digitally. We also provide end-to-end assistance for foreign founders with compliance and document submission.